Financial inclusion is positioned prominently as an enabler of other developmental goals in the 2030 Sustainable Development Goals, where it is featured as a target in eight of the seventeen goals. These include SDG1, on eradicating poverty; SDG 2 on ending hunger, achieving food security and promoting sustainable agriculture; SDG 3 on profiting health and well-being; SDG 5 on achieving gender equality and economic empowerment of women; SDG 8 on promoting economic growth and jobs; SDG 9 on supporting industry, innovation, and infrastructure; and SDG 10 on reducing inequality. Additionally, in SDG 17 on strengthening the means of implementation there is an implicit role for greater financial inclusion through greater savings mobilization for investment and consumption that can spur growth.

Ghashful started its Microfinance (MF) program since 1993 as a pilot project. In our country the marginalized people do not have the easy access to enjoy the facilities of saving, borrowing as well investing money in small but potential businesses. The services and supports provided by the Microfinance and Financial Inclusion program has remarkably enabled the poor and grassroots level potential entrepreneurs to get engaged with different income generating activities which in turn, allows them to become economically self-sufficient. In view of the fact, in 1997 the microfinance program became a core activity of Ghashful with the assistance of AAB. In 2005 with the aim to scale up the financial supports in different segments of the society and to increase income earning sectors and making employment, Ghashful started its new era of Microfinance through making partnership with PKSF. It has gradually created a self sustaining and reliable financial services for the marginalized and poor people.

Objectives of the Program

- To reduce poverty in Bangladesh;

- To develop savings tendency among the poor women and adolescents and build up equitable savings among them to reduce livelihood risks and vulnerability originated from lean season of income, various disasters, diseases and longtime inactiveness due to diseases, accidents etc.;

- To create self-employment and scope of wage employment through formation and enhancement of individual business competency of entrepreneurs;

- To provide financial services to the poor women and adolescents in order to facilitate their involvement in economic activities to foster their contribution to their household income;

- To increase the access of poor women and adolescents into the institutional credit and stop pauperization of poor due to loans they receive from the informal sources at a very high interest rate;

- To reduce the dependency of women on men and improve their dignity through raising their voices within the family and society by transforming them into income population;

- To utilize the local resources at the optimum level.

Strategies & Approaches

- Special focus on women’s empowerment;

- Priority on the poor and potential entrepreneurs;

- Participatory Management Approach;

- Conventional and Green Microfinance;

- Value Chain Development;

- Financial Inclusion with services;

- Risk Management

Revolving Loan Fund (RLF)

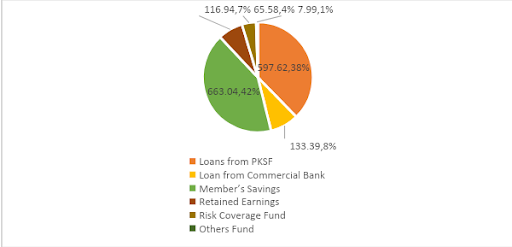

Revolving Loan Fund (RLF) has been one of the important elements to carry out the Micro Finance operations,. Ghashful RLF consists of different sources like Loan from PKSF, Member’s Savings, Retained Earnings and Risk coverage fund etc.

Contribution to Loan Fund (as on June 30 2020) in Million BDT –

| Source of RLF | Amount in BDT (2019-2020) | Percentage of Total Fund |

| Loans from PKSF | 597.62 | 37.72% |

| Loan from Commercial Bank | 133.39 | 8.42% |

| Member’s Savings | 663.04 | 41.84% |

| Retained Earnings | 116.94 | 7.38% |

| Risk Coverage Fund | 65.58 | 4.14% |

| Others Fund | 7.99 | 0.50% |

| Total | 100.00% | |

Amount Disbursed 2019

| AMOUNT DISBURSED | ||

| YEAR | AMOUNT | |

| 2019 | 1922.77 | |

| 2018 | 1788 | |

| 2017 | 1595.23 | |

| 2016 | 1565.3 | |

| 2015 | 1475 | |

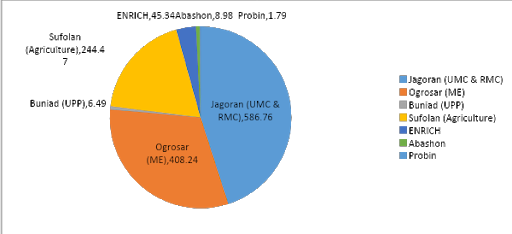

- Loan Portfolio Analysis 2019

- Loan Portfolio Analysis 2019

- Component wise portfolio 2019

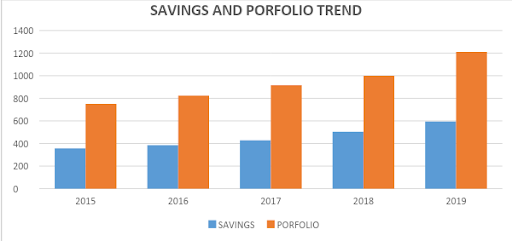

Savings and Portfolio Trend 2019

|

SAVINGS AND PORFOLIO TREND |

||

| YEAR | SAVINGS | PORFOLIO |

| 2015 | 356 | 750 |

| 2016 | 384.07 | 823.16 |

| 2017 | 428.97 | 915.8 |

| 2018 | 503.88 | 999.5 |

| 2019 | 594.8 | 1211.15 |

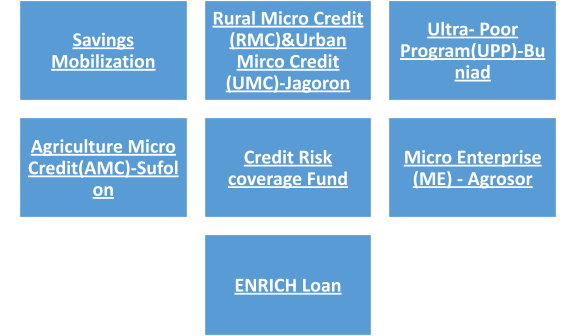

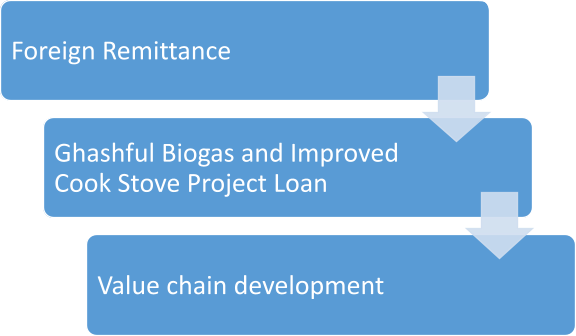

Project Interventions to Clients ( design)

Project Interventions

Target Clients

The marginalized and underprivileged people of the rural and urban population. Especially poor women, farmers and potential entrepreneurs.

Coverage Area

Chattogram, Feni, Comilla, Dhaka, Naogaon and ChapaiNawabganj districts of Bangladesh.

Process of implementation

Ghashful implements the microcredit and financial inclusion-oriented interventions based on the Savings and Credit Service to the clients.

The implementation of the program follows the following steps:

- The programs are initiated by forming Samity (Group) either in the urban or rural areas with active involvement of the local beneficiaries.

- The next step is to form a management committee that consists of a President, a Secretary and a Treasurer to strengthen the governance of the Samity. The committee members are democratically selected by the Samity members.

- The members can get the credit facility even before making savings without collateral through getting approval from the management committee that is confirmed in the weekly meeting of the Samity.

- In addition to the continuation of the regular activities of the local Samity, the administrative role for the Samity is carried out by the staff of Ghashful branch office under the supervision of the Branch Managers while the overall coordination and management of the program is run from Ghashful head office.

- Repayment of credits is also accounted in weekly Samity meeting besides running on the savings activities.

- Apart from adding the savings in regular basis, for paying the credit and collecting the installment, Ghashful tries to convert the Samity as transformation center for the community people by linking it with income generating activities, education facilities, skill training, comprehensive health packages and awareness raising on different social and health issues etc

At present Ghashful operates its microfinance program through 58 branch offices with the involvement of 442 MF staffs.

Performance Highlight as on June -2020

| Information | June -20 |

| Total No. of Branches | 58 |

| Total No. of Microfinance Staffs | 442 |

| Total No. of Member | 76316 |

| Total No. of Borrower | 57343 |

| Amount Disbursed (Cumulative)

(In Millions of BDT) |

16202.29 |

| Amount Recovered (Cumulative) | 14900.22 |

| Portfolio Outstanding

(In Millions of BDT) |

1302.07 |

| Savings Balance

(In Millions of BDT) |

663.04 |

Mobilization process of Savings for Sustainability General Savings

The most influential factor for running the whole operation is to prevail savings which mitigates the future demand for money. But often it is not an easy task to do. These extremely poor people can hardly go for savings from their very low income. It is pretty difficult for them to arrange investment to start any business to earn self-reliance and take them out of the vicious cycle of poverty. Ghashful initiated Savings opportunity for helping the poor people to earn self-sufficiency by getting them out of this vicious cycle, especially targeting the vulnerable community since the inception of its microfinance program.

To ensure the sustainability of the mobilization process of the savings services for the vulnerable people Ghashful has adopted two types of saving procedures:

- General Savings

- Term Deposit Scheme

General Savings: This type of savings is compulsory for all microfinance clients. The clients save money weekly in the group or Shamity at a fixed rate. The savers get a 6% interest per annum on their savings balance.

| No of Saver | Savings rate | Interest | Balance on June 2020 |

| 76316 | 6% | 37468145 | 471976760 |

Term Deposit Scheme (TDS)

In 2016, Ghashful has introduced the Term Deposit Scheme (TDS) as an additional saving opportunity for micro finance clients.

According to the Scheme, the clients can deposit an amount of BDT 100/ 200/ 300/ 400/ 500 monthly for five years duration. After completion of the tenure, they will receive a pre-declared amount with interest like below.

| Target people | Savings amount per month (BDT) | Duration | Interest | Savings balance on June 2020 Million (BDT) | Remarks |

| All microfinance client | 1363871 | 5years | 3931142 | 40.05 | Maturity after 5 years |

Voluntary savings

| Voluntary savings | Target People | Savings balance on June 2020 Million (BDT |

| All microfinance client | 151 |